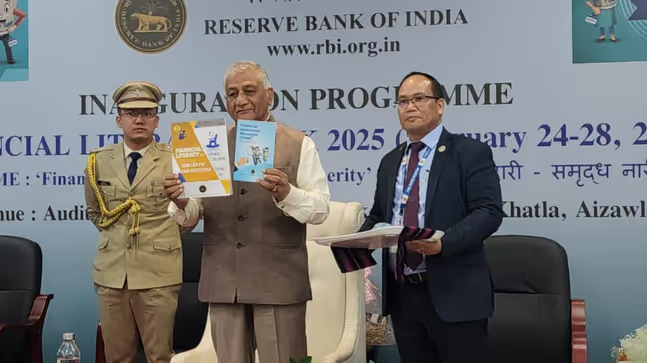

Mizoram Governor General Vijay Kumar Singh (Retd) inaugurated the Reserve Bank of India’s (RBI) ‘Financial Literacy Week 2025’ at the Mizoram Rural Bank (MRB) Head Office in Aizawl on Monday. The initiative aims to spread financial awareness across Mizoram, with a special focus on women’s economic empowerment.

During the event, Financial Literacy Messages Booklets were launched and will be distributed to 513 libraries across Mizoram to promote financial knowledge among citizens.

This year’s theme, ‘Financial Literacy – Women’s Prosperity,’ aligns with Vikshit Bharat 2047, a vision for India’s long-term economic growth. The campaign underscores the importance of financial inclusion for women and encourages banks and financial institutions to enhance financial access for all.

Key Highlights of RBI’s Financial Literacy Week 2025

✅ Theme: ‘Financial Literacy – Women’s Prosperity’

✅ Launch of Financial Literacy Messages Booklets for 513 libraries

✅ Centralized mass media campaign for financial awareness

✅ Promotion of financial inclusion and social security schemes

✅ Encouragement of banking and financial institutions to extend formal financial services

Governor Gen. (Dr) Vijay Kumar Singh’s Address

In his inaugural speech, Governor Vijay Kumar Singh praised the RBI’s commitment to financial literacy and emphasized the importance of economic empowerment for women.

Key Points from His Address:

✔️ Women’s Financial Inclusion: The Governor lauded this year’s theme, stating that empowering women financially is crucial for the nation’s progress.

✔️ Government’s Role: He highlighted various central government schemes supporting credit guarantees, social security, and entrepreneurship.

✔️ Call to Action for Banks & Financial Institutions: Singh urged all banks in Mizoram to ensure financial access for every citizen, helping them benefit from financial inclusion and social security schemes.

“All banks and financial institutions must ensure that all eligible persons can avail full benefits of financial inclusion, social security schemes, and credit guarantee systems,” – Governor Vijay Kumar Singh.

RBI’s Financial Awareness Initiatives

1. Financial Literacy Messages Booklets

To extend financial awareness across Mizoram, booklets containing key financial messages will be distributed to 513 libraries, ensuring that both rural and urban communities have access to financial education resources.

2. Centralized Mass Media Campaign

RBI’s Financial Literacy Week 2025 will include a nationwide mass media campaign that will share important financial awareness messages across various platforms.

3. Banking & Financial Inclusion Goals

RBI, in partnership with banks and financial institutions, will work towards:

✔️ Promoting women’s participation in formal banking

✔️ Encouraging savings and investment awareness

✔️ Ensuring easy access to credit and entrepreneurship opportunities

✔️ Educating citizens on secure banking practices and fraud prevention

Why Financial Literacy is Crucial for Women’s Prosperity?

Financial literacy plays a vital role in women’s empowerment by:

✔️ Enhancing economic independence

✔️ Encouraging better financial planning

✔️ Providing access to credit and business opportunities

✔️ Boosting participation in government welfare schemes

With Vikshit Bharat 2047 as a long-term vision, financial literacy among women will help bridge economic gaps and contribute to inclusive national growth.

Expert Insights from RBI Aizawl

T. Lhungdim, General Manager & Officer-in-Charge of RBI Aizawl, Stated:

🗣 “The objective behind Financial Literacy Week is to spread awareness among people about key financial topics through focused campaigns.”

He also confirmed that RBI will continue to use digital and traditional media to broadcast financial awareness messages throughout the week.

Impact of Financial Literacy Week on Mizoram

✅ Increased Awareness:

More citizens, especially women, will gain knowledge on banking, savings, and investment strategies.

✅ Boost in Financial Inclusion:

Encouraging more people to open bank accounts, access credit, and utilize digital banking services.

✅ Stronger Economy:

With women playing a more active role in financial decisions, Mizoram’s economy will witness improved financial stability and growth.

The launch of RBI’s Financial Literacy Week 2025 in Mizoram marks a major step towards women’s financial empowerment and economic development. With a focus on financial literacy, social security, and banking access, the initiative will enhance financial awareness and inclusion across the state.

Governor Vijay Kumar Singh’s emphasis on financial education aligns with India’s vision for Vikshit Bharat 2047, ensuring that financial resources and knowledge reach every household in Mizoram.

As Financial Literacy Week progresses, the RBI’s outreach programs will help transform financial awareness into action, creating a more financially inclusive society.