Introduction

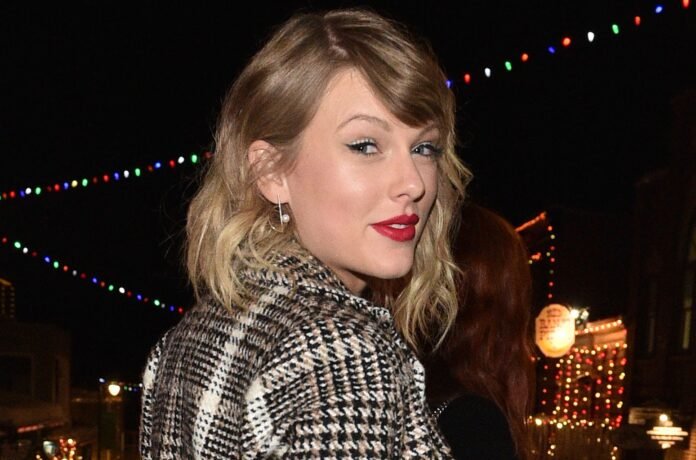

In the world of finance and investment, celebrity endorsements have traditionally been associated with consumer products and brands. However, a new trend is emerging, where prominent individuals like Taylor Swift, Warren Buffett, and Elon Musk are leveraging their influence to promote niche investment funds. This article delves into the growing phenomenon of celebrity endorsements in the investment realm, examining the motivations behind such partnerships, the impact on investor behavior, and the potential risks and benefits associated with this marketing strategy.

The Shift towards Celebrity Endorsements in Investment

Historically, investment products and funds were promoted through traditional means, such as advertisements, industry publications, and financial advisors. However, in recent years, there has been a noticeable shift towards leveraging the power of celebrity endorsements to capture the attention of investors. Celebrities from various fields, including music, entertainment, and business, are now lending their names and personal brands to endorse specific investment funds, often targeting niche markets.

Motivations Behind Celebrity Endorsements

There are several motivations behind celebrities aligning themselves with investment funds. For some, it may be a genuine belief in the fund’s objectives and a desire to use their platform to promote responsible investing. Others may view it as a lucrative business opportunity, leveraging their fame and credibility to earn endorsement fees or secure ownership stakes in the funds. Additionally, celebrities may also seek to diversify their own investment portfolios by investing in the funds they endorse, creating a symbiotic relationship.

The Impact on Investor Behavior

Celebrity endorsements have the potential to significantly impact investor behavior. When a well-known figure endorses a specific investment fund, it can create a sense of trust and credibility among their fan base or followers. Investors may be more likely to consider investing in a fund if it is associated with a celebrity they admire or respect. This can lead to increased inflows of capital into these funds, potentially influencing market dynamics and fund performance.

Risks and Benefits of Celebrity Endorsements in Investment

While celebrity endorsements can offer benefits for both the funds and the celebrities themselves, there are also risks involved. One of the main risks is the potential for conflicts of interest. If a celebrity endorser has a financial stake in the fund they promote, their endorsement may be perceived as biased, raising questions about transparency and objectivity. Additionally, there is a risk that investors may be swayed solely by the celebrity’s endorsement without conducting thorough due diligence on the fund’s investment strategy and performance.

On the other hand, celebrity endorsements can bring positive attention to niche investment funds that may otherwise struggle to gain visibility. It can broaden the fund’s reach, attract new investors, and increase overall awareness of specific investment themes or strategies. Moreover, celebrities who genuinely align themselves with responsible investment practices can help educate and raise awareness about sustainable investing and the importance of aligning values with financial decisions.

The Role of Regulation and Transparency

As celebrity endorsements in investment gain momentum, regulators and industry organizations are paying closer attention to ensure transparency and protect investors. Guidelines and regulations may be established to address conflicts of interest, disclosure requirements, and the need for clear disclaimers regarding the nature of the endorsements. This will help ensure that investors have access to accurate information and can make informed decisions based on unbiased assessments of investment opportunities.

Navigating the Celebrity Endorsement Landscape

For investors, it is crucial to approach celebrity endorsements with a discerning mindset. While a celebrity endorsement may capture attention, it should not be the sole basis for investment decisions. Conducting thorough research, analyzing the fund’s track record, understanding the investment strategy, and seeking advice from qualified financial professionals are essential steps to consider before committing capital to any investment opportunity.

Conclusion

The increasing presence of celebrity endorsements in the investment landscape is indicative of the evolving dynamics between fame, finance, and investor behavior. As celebrities like Taylor Swift, Warren Buffett, and Elon Musk lend their names to niche investment funds, the impact on investor perception and fund performance cannot be ignored. While there are potential risks associated with conflicts of interest and uninformed investment decisions, celebrity endorsements also offer opportunities to raise awareness, promote responsible investing, and attract capital to worthy investment strategies. As the trend continues to unfold, it is crucial for regulators, investors, and industry participants to navigate this landscape with transparency, diligence, and a critical eye towards balancing the benefits and risks of celebrity endorsements in the realm of investment.